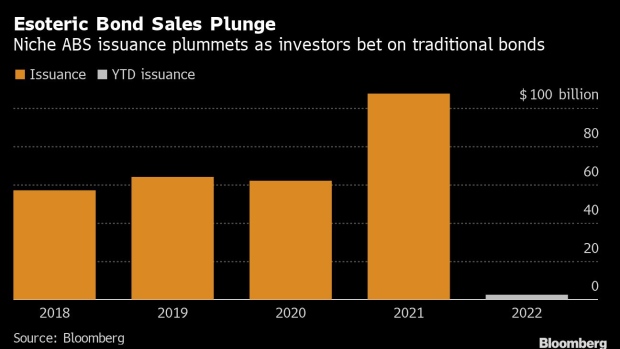

(Bloomberg) — Companies that issue exotic bonds are having a tough time getting deals done as macro-economic uncertainty rises and investors seek refuge in plain vanilla transactions. So, they are turning to a more traditional ally: private debt.

Borrowers in the esoteric ABS market repackage unusual assets into securities — ranging from royalties to aircraft and shipping containers — as opposed to conventional debt like credit cards or auto loans.

While overall non-traditional ABS is up year to date from last year, it’s not happening in all pockets of the esoteric market. There have been just two aircraft ABS sale — including those backed by commercial and business aviation — compared to eight at this point last year. And in whole business deals, there’s also been a decrease, with ten deals pricing year to date, compared to 14 at the same time last year.

As uncertainty…