As variable-rate mortgage holders eagerly anticipate the Bank of Canada’s first rate cut, fixed rates are heading in the other direction: up.

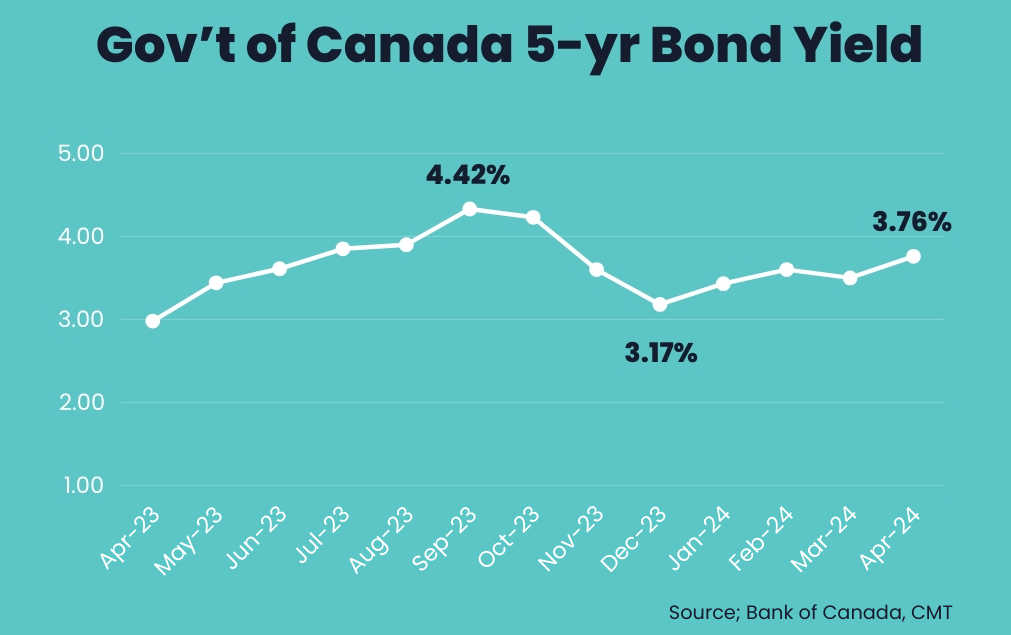

After peaking in early October, Government of Canada bond yields—which lead fixed mortgage rates—plummeted by 125 basis points, or 1.25 percentage points, by early January.

Since reaching that low, they’ve rebounded by approximately 60 bps, with around 25-bps worth of those gains seen in the past three weeks. As a result, fixed mortgage rates are being taken along for the ride.

Strong economic data to blame

Rate expert Ron Butler of Butler Mortgage says 2- to 5-year fixed mortgage rates are up across various lenders by anywhere from 15 to 30 bps in recent weeks.

Butler says the gains are being driven primarily by recent U.S. data, including strong employment, GDP and inflation figures….