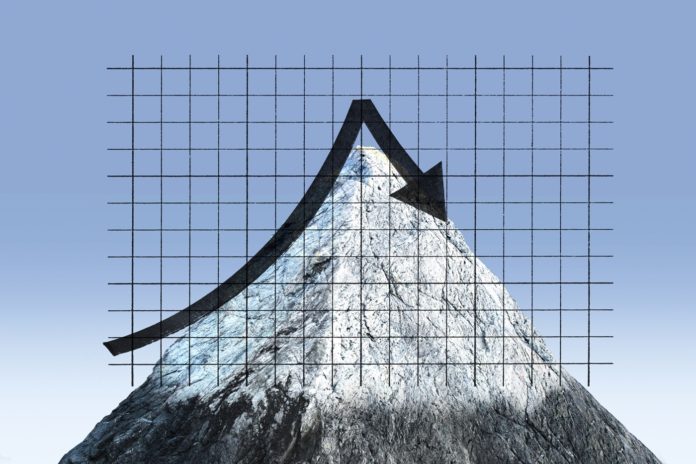

Bond yields dove over 30 basis points on Friday as economic worries start to replace inflation concerns.

Bond yields, which lead fixed mortgage rates, fell to 2.84% on Friday, down from 3.15% on Thursday and well off the 3.59% high reached in mid-June.

The decline comes due to growing expectations of an economic downturn.

Rate analyst Rob McLister, editor of MortgageLogic.news, said most bond traders think inflation is nearing its peak and that “the recession risk is real.”

June inflation data released this week showed a headline reading of 8.1%—its highest level since 1983—though still slightly less than what markets had expected. Core inflation, on the other hand, rose to 5%, up from 4.73% in May.

What it means for fixed mortgage rates

“The thinking is that central banks will soon have broken the economy,” McLister told…