NatanaelGinting

Responding To The Doubters

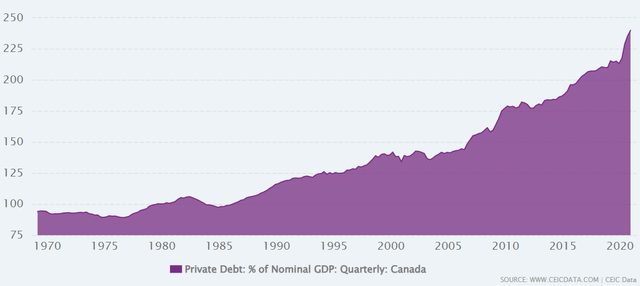

Five months ago, we wrote the article “TD And Royal Bank: Canada’s About To Implode.” In the article, we argued that Canadian banks are priced too richly given where Canada stands in the debt cycle. Canada now has a private debt to GDP ratio of 230%:

Canada’s Private Debt As A Percent Of GDP (CEIC)

For reference, before the American financial system melted down in 2008, the United States had a private debt to GDP ratio of just 170%.

We got a lot of pushback on the first article in this series, especially on the strength of Canada’s financial system. While the country’s financial system may be stronger than that of the U.S. in 2008, we’d argue it is now more vulnerable than ever before. We’ll see why. In the decade ahead, we project returns of 5% per annum for The Toronto-Dominion Bank (NYSE:TD) and Royal Bank of Canada (NYSE:RY). But, it…